FIA Pre-Budget Representation to the

Union Finance Ministry

I. ADDRESS ATF PRICING BY RATIONALIZING TAXES & DUTIES

Excessively priced Jet Fuel (ATF) in India is a long-standing and an unresolved issue which is contributing to the large losses being incurred by the Indian Airline industry. The ATF-imposed cost burden on Indian carriers not only makes them steadily lose fiscal-competitiveness, but also leaves the airline industry with fewer resources to invest in its future - in enhancing passenger servicing; in revamping fleet & facilities; in retaining its employees; and also in expanding air connectivity in India.

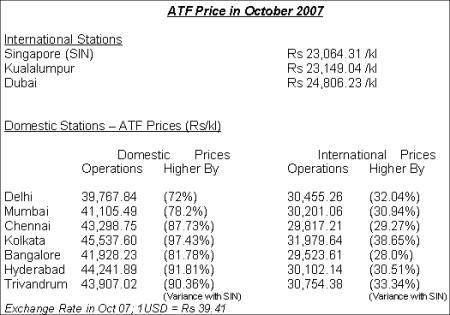

ATF rates for domestic operations in India are priced 70%-90% higher than international benchmarks. Fuel alone accounts for close to more than 40% of the total operating costs for airlines in India.

The wide-variance between the international bench-mark ATF price and the price paid by Indian carriers, can be seen from the below table on ATF price at different stations in October 2007. This price variance needs to be corrected.

India is also a net ATF exporter and the Indian oil companies sell the same in the overseas markets at basic prices lesser than that offered in the domestic market.

To address this 'unsustainable' disparity in the price of ATF for domestic airlines, FIA would urge the following measures for ATF pricing in India, to restore some parity with costs of other modes of transport as well as international carriers;

- Declared Good status for ATF: The Airline industry had recommended that ATF altogether be given a "declared goods" status, thereby attracting a uniform 4% sales tax across India.

Budget 07-08 addressed the FIA recommendation only partially by removing the anomaly between turbo-prop and regional jet aircrafts benefiting no more than 10 aircraft for the whole industry. We would once again request the Ministry of Finance to kindly grant a "declared goods" status to ATF altogether, to restore the financial health of the Airline industry.

Due to varying tax structure in different states, the airlines have to carry extra fuel which in turn results into burning more fuel thereby causing an avoidable personal and national loss. - Customs Duty:Customs duty on ATF for domestic operations should be reduced to 5%.

Also, while the fuel suppliers have been allowed custom duty exemption on import of crude (for ATF uplifted by foreign bound aircraft) in Apr'06, till date the Oil Companies have not passed any benefit from the customs duty exemption to the airlines. FIA would request this to be addressed.

- Excise Duty: Excise duty on ATF should be made 4%.

FIA would request review of the applicability of Service tax on F&J class tickets on international travel; and on landing and air navigation fees.

- F & J Class Tickets: Finance Act 2006 amended the provisions of Finance Act 1994 to include the definition of 'Taxable Services', 'fare charged' to business class and first class passengers embarking on international journeys from any customs airport in India.

The ICAO Policies (Doc 8632) do not support taxes on aviation, including on the sale and use of international air transport. India is an important constituent of ICAO and since the policies are based on the tenet of reciprocity, India should uphold its commitment to this international convention and remove the tax.

This provision is also logistically difficult to implement as fares charged, passenger routings (domestic + international) vary; alongwith complexities on upgrades, interline tickets etc. - Service tax on landing, airport & air navigation fees: India has also imposed a 12.36% service tax fee on landing, airport and air navigation fees. FIA would urge that this reduces the competitiveness of India's air transport sector and should be removed.

III. FRINGE BENEFIT TAX

Finance Act 2005 had introduced a tax on fringe benefits. This tax has also been made applicable on free / concessional passages granted to airline executives and family; expenses for crew; hotel accommodation provided to passengers due to delays & cancellations; and expenses on catering and inflight entertainment.

None of these items can be considered 'fringe benefits'; and FIA requests these items to be removed from the coverage of FBT.

- Free / concessional passages granted to employees & their family: All employees of airlines are entitled to free / concessional passages in accordance with IATA Regulations. These tickets are purely on the basis of subject to availability (otherwise the seats are destined to go empty any which way). As per the provisions of FBT, these free / concessional tickets have to be valued at the fare at which these tickets are offered to the public.

The airlines do not grant any LTA/LTC benefit to the employees. Instead free / concessional passages are granted which do not involve cash outflow for the airline. Just as LTA is exempted under the Income Tax Act and since these passages are in lieu of LTA, the same treatment should be accorded to free / concessional passages.

Further, a ticket provided to airline staff cannot be valued as per the laid out rule currently of value of a similar ticket offered to revenue passengers, as these tickets are subject to availability of space and are without confirmation. - Crew Expenses: Expenses on crew such as hotel accommodation cannot be considered as "fringe benefit" as crew do not gain any personal benefit out of this. Further, with paucity of parking space in major metros, airlines are forced to park aircraft at various other airports (where crews are not domiciled) and have to station crews for operating the aircraft in the morning. Airlines cannot run the aircraft without crew and expenses on hotel for crew is a major part of such crew expenditure incurred by any airline. Due to flight duty time limitations, rest and scheduling requirements, which are laid out by DGCA in line with international norms, the crew is required to layover at various points/stations in the airline's network. In view of the distances, time differences etc. the crew has necessarily to be provided with hotel at such points of layover. Therefore, hotel accommodation provided for crew layovers cannot be considered under the FBT, as it is an operating expenditure for airlines.

- Passenger Hotel Accommodation: Hotel accommodation is provided when flights have been delayed, cancelled, or when they have been denied boarding. It is an operations necessity as passengers are required to be provided such accommodation during such events. Expenditure on providing passengers hotel accommodations therefore, cannot be considered a "fringe benefit". In the case of international flights too, expenses are incurred in providing hotel accommodation whenever flights are delayed and/or the passengers has been denied boarding or any such emergency. Universally, airlines account for this type of expenses as passenger amenities, which is separately identified and accounted as such. A clarification to this effect may be issued. Considering that the objective of FBT is to tax "embedded employee benefits", taxing of expenditure incurred on passenger hotel accommodation is not intention of the law makers.

- Catering and Inflight entertainment expenses: Catering and Inflight entertainment are provided by carriers as a part of amenities to passengers. It is a key differentiator for many carriers operating anywhere in the world, and an integral part of the product offering.

A reading of the current provisions of Income Tax act suggests that the expenditure incurred on Inflight catering and entertainment could come under the definition of 'hospitality' and thereby are a "fringe benefit" attracting FBT on such expenses. However, it may be noted that the term 'hospitality' is akin to acts done gratuitously, and not services provided at a charge. That the passenger is in fact paying for these services is demonstrated by the fact that the airlines not providing such services/facilities (e.g. the LCCs or No-frills carriers) charge a lower fare than the full service carriers.

A guidance note issued by the 'Institute of Chartered Accountants of India' in the case of a hotel industry and also an opinion issued by a renowned Chartered Accountants firm, also indicate that such amenities provided by carriers as a part of their regular service cannot be considered as "fringe benefits".

Expenditure on providing catering on board, and inflight entertainment cannot, therefore be considered a "fringe benefit", as such a treatment will clearly discourages carriers to offer any amenities on board.

Finance Act 2007 extended the benefits of carry-forward and set-off of accumulated losses and unabsorbed depreciation available, to amalgamation of one or more Public Sector Company or companies engaged in the business of operation of aircraft with one or more public sector company or companies engaged in similar business. This was done by amending provisions of the Section 72A.

The environment in which the different airlines operate & the high capital costs associated with the airline business, are the same for both the public and the private sector airlines.

FIA would urge the provisions of this amendment to be also made available to private sector companies engaged in the business of operation of aircraft.

V. CENVAT CREDIT ON ATF

It has been opined by the Service Tax Department that availment of credit of Excise duty paid on ATF is not available under the provisions of the CENVAT Credit Rules, 2004 ("CCR, 2004") as is in force today.

This view is contrary to the language and scope of the provisions of the CCR, 2004, in terms of which credit of Excise duty is available in respect of all "Inputs" other than specifically excluded inputs. Non-allowance of credit to the airlines on ATF is against the fundamental principle of the CENVAT provisions which may result in the cascading effect of taxes. In this regard, a representation has been filed with the Ministry of Finance on 28th August' 2006 submitting that:

- ATF credit is available to an Airline Company in terms of Rule 3 of the CCR, 2004;

- Further, ATF is distinct from LDO, HDO and Motor spirit and as such ATF is not specifically excluded under the definition of inputs under CCR, 2004;

- ATF is received at the premises of airlines i.e. at the various Airports in the country, where the airlines have their offices / operations; and

- ATF is used as an "Input" for providing taxable service.

VI. REINSTATE TAX EXEMPTION FOR FOREIGN PILOTS AND ENGINEERS FOR 36 MONTHS

Prior to deletion of Section 10(6)(vii) of the Income Tax Act 1961, foreign technicians enjoyed tax exemption for a period of 36 months from the date of arrival in India. This helped several industries to develop the necessary skilled personnel for management of the industries which needed skilled and technical personnel.

The shortage of pilots in India is well known and whilst the steps have been taken to recruit more first-officers, the latter would take minimum 2500 flying hours or 3 years to take command. The Airline industry has missed this exemption and an exemption in line with the afore mentioned section would help the industry to attract foreign Pilots and Engineers, till such time the local talent is developed.

Other Issues

In addition to the above, FIA would like to request that these below earlier recommendations of the Airline industry be also considered favourably;

VII. EXEMPT SUPPLIES MEANT FOR CONSUMPTION ON INTERNATIONAL FLIGHTS FROM SALES TAX / VAT

VIII. REINSTATE EXEMPTION FROM PAYMENT OF WITHOLDING TAX ON LEASE RENTAL INCOMES ON AIRCRAFT AND ENGINES EARNED BY A NON-RESIDENT LESSOR FROM AN INDIAN COMPANY

[SECTION 10(15A) of IT Act of 1961]

IX. REINSTATE EXEMPTION FOR INCOME IN RESPECT OF INTEREST PAYABLE ON MONIES BORROWED ABROAD

[Sections 10(15)(iv)(b) & 10(15)(iv)(c)]